Boston Real Estate Prices Up Up and Away?!?

A few years ago I sent out a market update with the following picture and caption…

Picture the milk or bread aisle in a grocery store the morning before a big New England snowstorm and you’ll have a pretty good idea of what the 2013 housing market was like!

That was 3 years ago and the picture and description are still spot on! The ony difference? Even higher prices.

Little Inventory + Lot’s of Buyers = Rising Prices

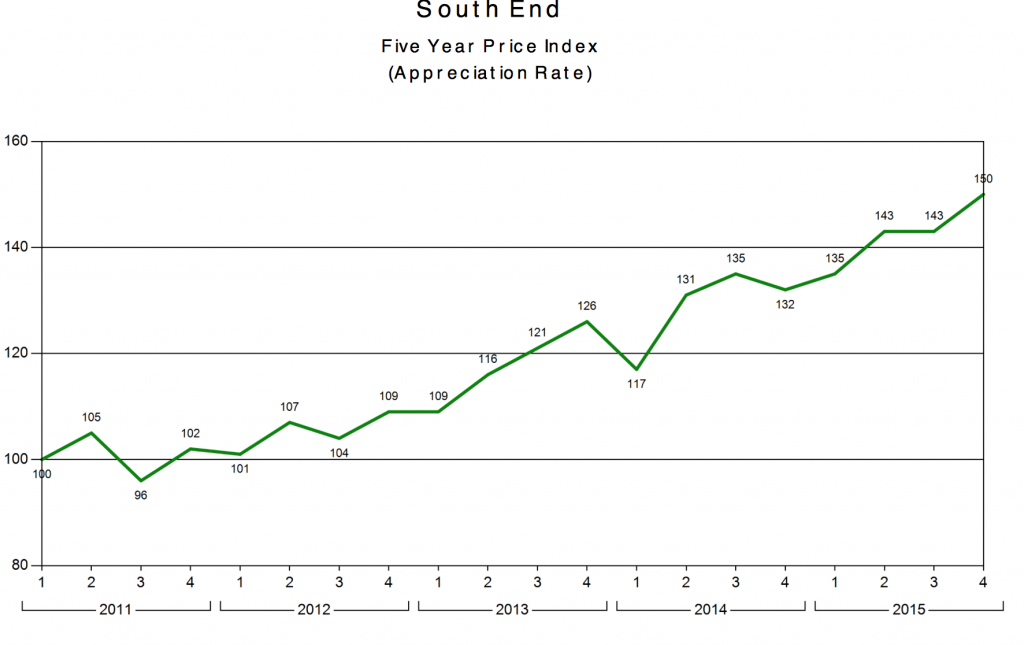

I don’t need to pull out my Brandeis Economics degree to know when demand is high and supply is low, prices rise. That’s been true throughout the city. The question is, how much? Let’s use the South End as our example neighborhood since it’s seen some of the most dramatic price increases and will make a good example case. Let’s run the numbers:

As you can see prices are up a whopping 50% since beginning of 2011, with most of that gain starting in 2013 as the financial crisis receded. That is an incredible rise. The big question, will it continue?

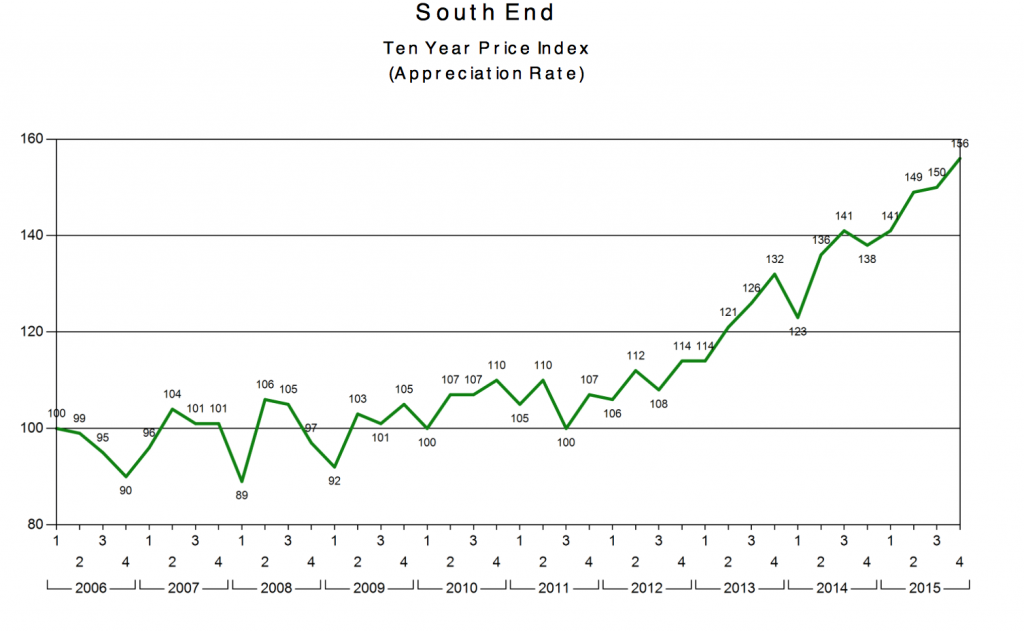

Historic Perspective Can Help

Let’s take a 10 year look and see what’s happened to prices from before the financial crisis hit up until today. As shown below, prices are up 56% over that 10 year period. And 56% over 10 years sounds much more reasonable than 50% over 5 years.

In other words, prices were nearly flat from 2006 until mid way through 2011, then began to recover and recover quickly. Which leads me to….

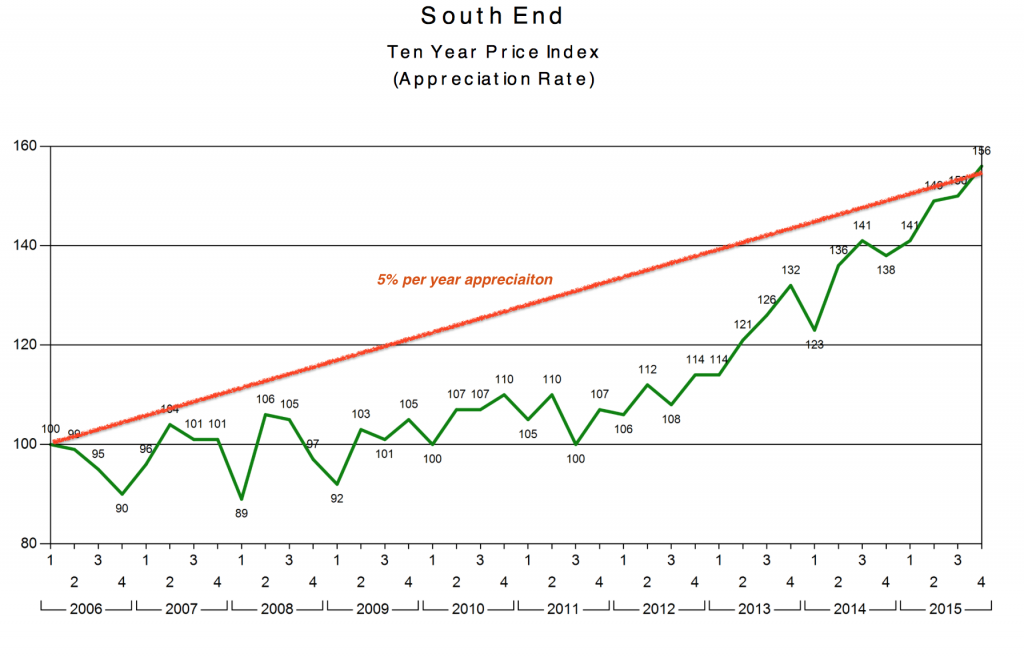

My Very Own Personal Price Theory

In speaking with clients over the past year or so, I’ve shared my gut feeling that the huge price jumps we’ve seen in recent years represented the market making up for lost time. We were flat for 5 years and have been playing catch-up for the past 5.

But am I right? Are we making up for lost time? Well if you believe that a 5% annual rise in house prices is a robust but not unreasonable amount in a “normal” market, I may very well be correct. Look what happens if we plot a 5% appreciation lin on the 10 year graph:

Voila! We are almost exactly where we would be if the financial crisis never happened and we enjoyed “normal” 5% growth per year. Maybe all those Economics classes did teach me something after all.

What about 2016?

If we have theoretically caught up with the 10 year trend line, what happens next? Do prices continue their rocket ride? Or do things tapper back towards more typical growth?

My gut tells me we may see price increases taper a bit as we cross that 10 year trend line of 5% annual growth. That said, the Boston economy is enjoying robust growth helping to fuel the luxury market which drives prices higher. The Fed, while finally beginning to raise rates, still seems quite shy about doing it at anything other than a snail’s pace. And unless our sellers finally come out in droves, supply will remain tight.

It’s still early in the year of course but so far those sellers are still few and far between. Here are the condo numbers in the South End since 1/4/16:

- 24 new condos listed

- 20 of those went under agreement, most within 1 week

- 4 have yet to find a buyer.

What’s more, right now there are just 29 condos for sale at any price in the South End and 5 of those aren’t even built yet. With those numbers in mind, so far 2016 is looking an awful lot like 2015.

In Conclusion

If you are a potential buyer, waiting is NOT a good strategy, and it never really has been a good one in Boston. Prices are likely to continue rising – the home you want this year will be more expensive next year. And if interest rates rise further, not only will your mortgage payment cost you more, you may qualify for less purchasing power and be forced to buy a lesser home. With low inventory, it’s never too early to start your home search so get in touch now so we can get started.

If you are a potential seller, there has never been a better time to sell. Yes your home may be worth more next year, but the home you want to buy will be more expensive too. Plus if rates rise, your mortgage payment on that new home will be higher and you may qualify for less money as well. I’m happy to let you know just how much your home is worth in today’s market and how best to position it for top dollar.

So that’s my take on the market at the moment and I hope you found it useful. If you liked it, please feel free to share it using one of the icons on the right.

P.S. keep in mind while I used the South End as the example here, I’m happy to let you know what’s going on your specific neighborhood too – just ask me! In the meantime if you want to get a quick automated estimate of your home’s worth, fill out the form below. Or better yet, send me a note and I’d be happy to provide a more in-depth analysis.